In my previous post, I outlined the inner workings of a traditional Home Equity Line of Credit (HELOC). Today, I’d like to share with you how a Home Equity Conversion Mortgage (HECM) works. HECMs are also commonly known as “Reverse Mortgages.” We’ll discuss:

- Closing costs

- Lending limits

- Payment triggers

- Pros & cons of HELOCs and HECMs

HELOC or Reverse Mortgage? Pt. 2: Reverse Mortgage Features

HECMs are specifically designed for borrowers age 62 or older and have a litany of beneficial features. They differ from HELOCs in a few key areas. Let’s explore.

1. Closing Costs

The total closing cost of a Reverse Mortgage is higher than some other home financing options. This is because of two primary factors.

The first factor is that the loan is insured by the Federal Housing Authority (FHA). FHA insures the loan so that the home stands 100% good for the loan. This insurance protects both you and your estate in case the HECM balance ever exceeds the property value. Even though this insurance is mandated by FHA and comes at a cost to the borrower, it may prove to be invaluable.

The second factor is the origination cost. This is a cost that the lender charges in order to pay for its day-to-day operation. The rest of the cost consists of typical charges in a real estate transaction, such as appraisal and title fees.

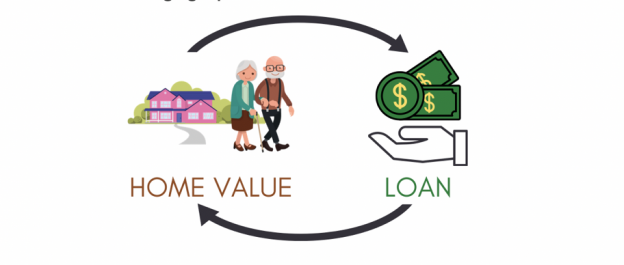

2. Lending Limits

Now let’s take a look at how lending limits are determined for a HECM. FHA provides a formula based on three primary factors.

- The age of the youngest borrower

- The appraised value of the property

- The current interest rate

The older the borrower, the more loan value is available to them. So, a 72-year-old can expect to receive more than a 62-year-old. Now remember, the entire amount is guaranteed by FHA to always be available.

Here’s an example: let’s assume that we have another housing crisis similar to what we experienced in 2008. The line of credit that a borrower has available to them through a HECM loan cannot be suspended – for any reason. Access to these funds is guaranteed by FHA. On the other hand, as you will remember from my previous post, the same could not be said for a borrower who had a traditional home equity line of credit during a drastic downturn in the real estate market. Their account could be frozen.

3. Payment Triggers

Now, let’s look at what triggers payment for a HECM. The HECM loan is unique in the fact that all mortgage payments are deferred while the borrower is living in the home as their primary residence. So, when the last surviving borrower passes away, sells the home, or goes to a long-term care facility, the loan comes due.

The family or the borrower have certain options at that time. The first option is to sell the home. Any money that remains after paying off the HECM will go to the borrower. If the borrower is deceased, the estate would receive any proceeds remaining after the HECM has been fully paid. The borrower or the estate would have up to one year to sell the home once it has been vacated. There is no deadline to sell the home as long as the borrower is living in the home while they are in the process of selling it.

The second option for the estate is to keep the property. In this scenario, the borrower is only required to pay off what is owed at the time the loan comes due. They are then free to manage the property in any way they would like.

The final option for the estate is to deed the property over to the lender in lieu of payment. This usually would happen if the real estate market has taken a downturn at the time the loan comes due. The family has the assurance that they can use the property to pay off the loan with zero liability. This goes back to the benefit of the loan being insured by FHA. If the borrower gets to the point that they need to permanently vacate the property, they can also return the property to the lender with zero liability to their personal assets or savings. Contrast this with a traditional line of credit that typically has an interest-only payment due for the first 5 to 10 years of the contract and then must be renewed or paid off.

This last option can obviously be of substantial benefit to a retired individual. No monthly mortgage during a time of fixed income says a lot. However, the fact that the Reverse Mortgage will never require renewal while the borrower keeps the home as a primary residence can be an equally attractive benefit.

Reverse Mortgage& HELOC Pros & Cons

Let’s take a final look at a list of pros and cons of the Reverse Mortgage and the pros and cons of the traditional Home Equity Line of Credit.

HELOC Pros

- Low closing cost

- More money can be borrowed based on the home’s value

HELOC Cons

- The loan will need to be renewed or paid in full in 5 or 10 years

- Monthly mortgage payment goes up when rates go up or after renewal date

- The bank can stop access to loan proceeds with little notice in a market downturn

Reverse Mortgage Pros

- The loan will never need to be renewed

- There is no monthly mortgage payment while the borrower remains in the home

- Access to the loan proceeds can never be denied for any reason – guaranteed by FHA

Reverse Mortgage Cons

- Higher closing costs

- Less money can be lent initially

- The home’s equity will diminish over time because of no required monthly mortgage payment

We’re Here to Help

In closing, I sincerely hope that I have provided some valuable insight into the differences, pros and cons of both the traditional Home Equity Line of Credit and the Reverse Mortgage line of credit. I also hope it helps a potential borrower or their loved ones make the right decision when using home equity as a part of a retirement strategy. In full disclosure, my company only offers the Reverse Mortgage loan. However, we firmly believe in its value to our community.

We have over 2,000 clients with unique stories, and we have been a part of a solution for all of them. We feel strongly about the Reverse Mortgage option because it was designed and insured by FHA specifically for retired individuals. Please feel free to contact me any time for a consultation.